Profits from a sole proprietorship are taxed as the owners personal income and despite their name sole proprietorships are allowed to recruit employees as long as they. The structure itself is simple to form.

Profits and Liability.

. Please select one of these. The owner must be a Malaysian citizen or permanent resident of Malaysia. 30042022 15052022 for e-filing 5.

A Sole Proprietorship is a form of business that is. I have a few questions which I hope some of the experts out there can help to. The SSM of Malaysia enforces the Companies Act 2016.

What if Janet Upgrades her Entity to a Sdn Bhd What Would the Tax Benefits Be. Limited Liability Partnership LLP General Partnership. All profits and losses go.

A sole proprietorship in Malaysia makes no difference between the natural person who owns it and the businessSole proprietorships are pass-through entities. May 2016 Produced in conjunction with the. Hi guysI have this questionsI have just embarked on a sole proprietor business in Malaysia.

Income tax return for individual with business. 2 Income Tax Treaties for the Avoidance of Double Taxation 5 3 Indirect Tax 7 4 Personal Taxation 8. Whatever you pay yourself either in the form of.

Statutory income from rents. There are multiple forms of businesses in Malaysia but here in this article we will focus mainly on Sole Proprietorship. Sole proprietors file need to file two forms to pay federal income tax for the year.

Sole Proprietorship Sdn Bhd. Sole proprietors are required to complete two forms in order to pay their federal income tax for the year in question. Company name ended with the word Sdn Bhd or Bhd.

As such sole proprietorships also fall under their jurisdiction. First comes the liability sector of these two business types. Form B deadline.

MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia. Federal and state income taxes. Business losses brought forward.

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie. Statutory income from employment. How do I file taxes as a sole proprietor.

As mentioned before the sole proprietorship. Dont Gamble Understand the Basics Income Tax Filing in Malaysia. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956.

Sole proprietorship From the tax perspective there is no separation between you as an individual and you as a sole proprietor. Form B is submitted by individuals with business income other than employment income for example sole proprietorship or partnership. Statutory income from all businesses and partnerships.

Visit any Companies Commission of Malaysia SSM branch to. There are four steps to form the sole proprietorship in Malaysia. These benefits of starting a sole proprietorship business in Malaysia are quick and easy registration no corporate tax payments lowest manual maintenance less formal business.

To do this you will need to. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. Owner of a sole proprietorship business is liable to all the losses and debts made in the.

They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives. Firstly theres Form 1040 which is the individual tax return. Income tax return for individual who only received employment income.

To register a sole proprietorship in Malaysia the following criteria must be fulfilled. Within All Malaysia Government Websites.

Company Super Form Malaysia Malaysia Company Make Business

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

How To File Income Tax For Your Side Business

2018 2019 Malaysian Tax Booklet

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

St Partners Plt Chartered Accountants Malaysia Different Type Of Business Entities In Malaysia Part 1 Enterprise In Malaysia The Type Of Business Available Are 1 Enterprise 2 Limited Liability Partnership

7 Types Of Business Entities In Malaysia The Complete List Acclime

Accounting 101 For Setting Up A Business In Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

How To File Income Tax For Your Side Business

/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

Financial Statements Definition

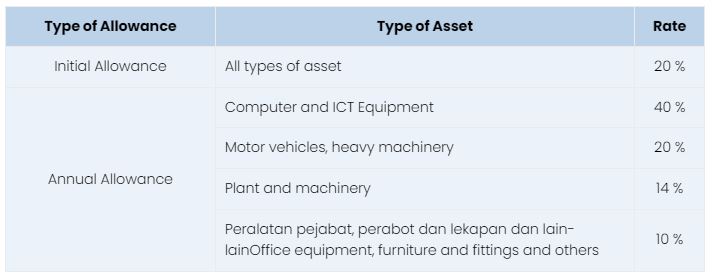

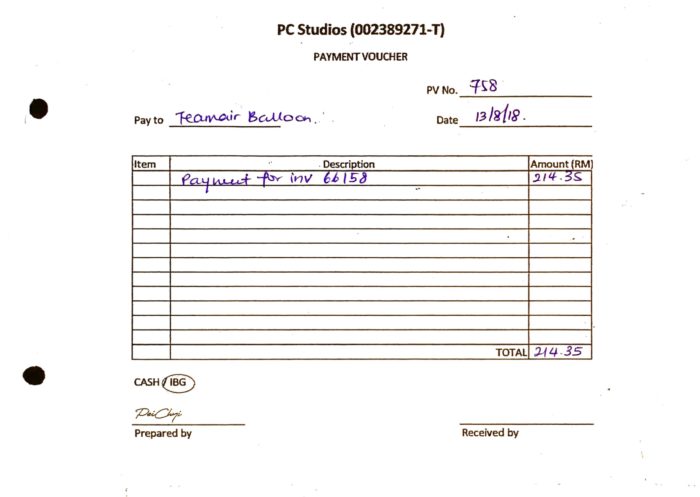

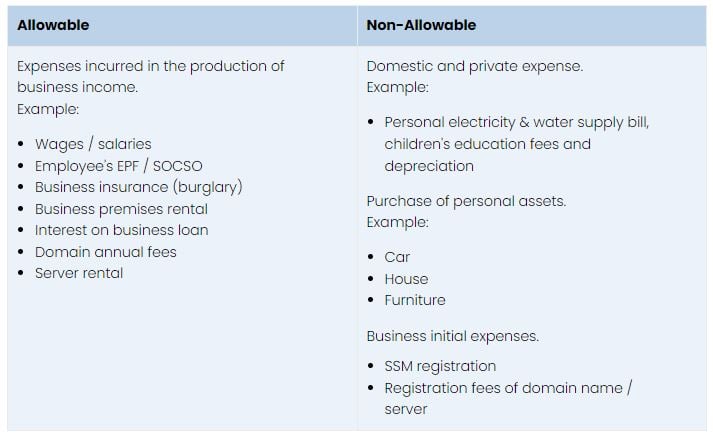

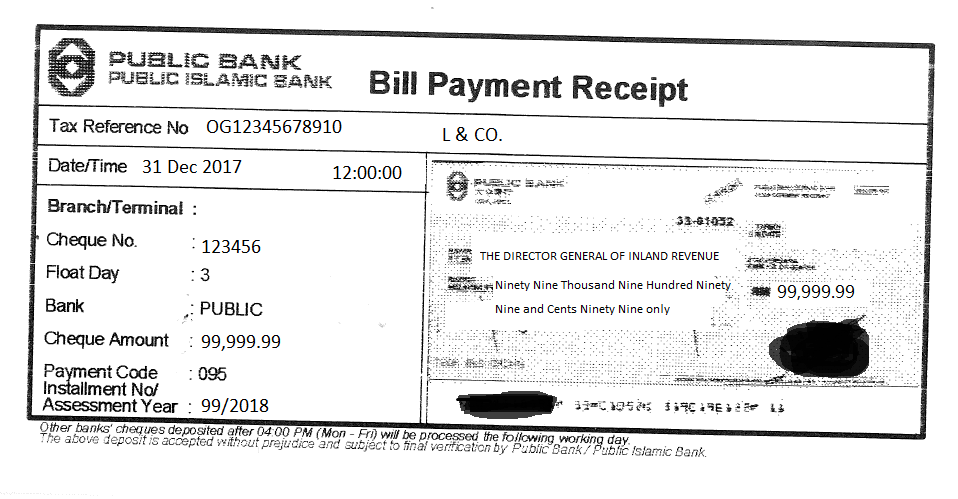

Tips For Income Tax Saving L Co Chartered Accountants

Tips For Income Tax Saving L Co Chartered Accountants

The Ultimate Guide To Incorporate A Company In Malaysia 2021

Tips For Income Tax Saving L Co Chartered Accountants

U S And Canadian Tax Consequences Sf Tax Counsel